AIF and SIF: What’s the Difference and Which One Should You Choose?

Saxena Varun 4 min read 25In the evolving landscape of alternative investments, two acronyms often create curiosity (and confusion) among investors: (Alternative Investment Fund) AIF and SIF (Special Investment Fund). While both cater to investors looking beyond traditional stocks and mutual funds, they are structurally and operationally different.

At Rits Capital, we simplify complex investment concepts to help you make smarter wealth decisions. Let’s decode AIFs and SIFs — understand their structure, regulations, risk-reward potential, and discover which suits your portfolio better.

What is an AIF (Alternative Investment Fund)?

AIFs are privately pooled investment vehicles regulated by SEBI (Securities and Exchange Board of India). These funds collect money from investors (Indian or foreign) and invest according to a defined strategy.

AIFs were officially introduced in India in 2012 under SEBI (AIF) Regulations, and have since grown into a ₹10 lakh crore industry (as of March 2025).

What is AIF Investment?

AIFs cater to investors seeking higher returns through alternative asset classes. They are ideal for long-term portfolios.

Types of AIFs:

- Category I – Venture Capital Funds, Angel Funds, Social Venture Funds

- Category II – Private Equity, Debt Funds (most common for HNIs)

- Category III – Hedge Funds, Long/Short Funds, High-risk strategies

Who Invests?

High-Net-Worth Individuals (HNIs)

- Family Offices

- Corporates

Institutional investors

AIF Minimum Investment (SEBI):

* ₹1 crore (minimum)

- ₹25 lakh for employees/directors of the fund

Lock-in Period:

- Typically 3–7 years depending on fund strategy

What is a SIF (Special Investment Fund)?

A SIF is an unregulated or lightly regulated investment platform created for private pooling of capital by investors with shared interests. Unlike AIFs, SIFs are not governed by SEBI regulations, making them more flexible — but also riskier.

What is SIF Investment?

SIFs are used for curated investment opportunities like pre-IPO shares, real estate deals, or distressed asset strategies.

SIFs are often used by:

- Wealth managers for HNIs and UHNIs

- Fintechs for early-stage startups or pre-IPO opportunities

- Investment platforms offering curated private deals

SIF investment for retail investors is gaining popularity due to low ticket sizes and targeted returns.

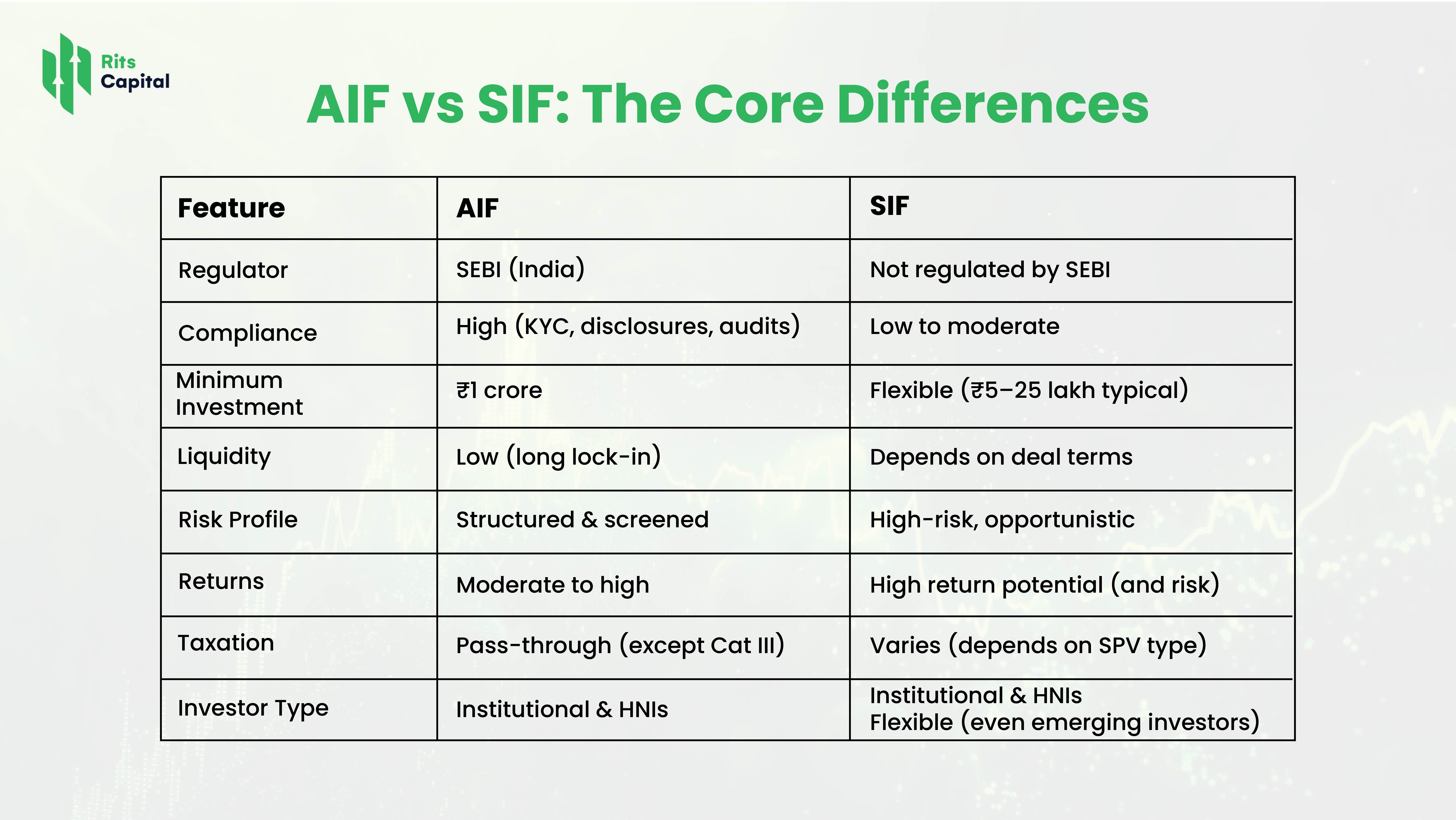

AIF and SIF: The Core Differences:

Why Do Investors Prefer AIFs?

1. Regulatory Trust

Backed by SEBI, AIFs offer greater transparency and investor protection.

- Access to Exclusive Assets

Private equity, infrastructure, venture capital, and even art or wine funds—AIFs open doors.

- Managed by Professionals

Top asset managers and fund houses like Edelweiss, ICICI, IIFL run AIFs with clear mandates.

Diversification

AIFs often invest in multiple opportunities, reducing concentration risk.

Why SIFs Are Growing in Popularity ?

1. Lower Ticket Size

Not everyone can commit ₹1 crore. SIFs start from as low as ₹10-25 lakh, making them accessible.

- Deal-Based Investing

SIFs allow you to invest in specific opportunities — like pre-IPO shares of NSE or Ola Electric — with defined exit timelines.

- Speed & Flexibility

Unlike AIFs which require months for approvals and onboarding, SIFs are nimble and quick.

4. Co-investment Culture

Investors pool funds with peers or institutional players, sharing due diligence and insights.

Let’s say you want to invest in NSE before its IPO (slated for late 2025). Through:

- AIF: You might need to join a private equity fund with a ₹1 crore minimum. The fund invests across 8–10 companies, including NSE.

- SIF (via Rits Capital): You could participate in a focused NSE-only SPV for ₹10–25 lakh, with clear entry price, timeline, and exit strategy.

This model helps investors take sharper bets, without locking huge capital in a broader AIF mandate.

What Rits Capital Recommends

Both AIFs and SIFs serve different needs. At Rits Capital, we help clients blend the structure of AIFs with the flexibility of SIFs.

Choose AIFs if you:

- Want regulated, professionally managed exposure.

- Are investing ₹1 crore+ with long-term goals.

- Prefer multi-asset, diversified strategies.

Choose SIFs if you:

- Are looking for shorter-term, higher alpha opportunities.

- Have lower ticket sizes (₹5–50 lakh).

- Want to bet on specific themes (pre-IPO, real estate, distressed assets).

The Final Word

Alternative investing is no longer a niche space. With rising interest from India’s affluent class, family offices, and fintech-savvy millennials, AIFs and SIFs are becoming the new frontier of wealth creation.

At Rits Capital, we don’t just give access — we give clarity, control, and confidence. Whether you’re an HNI entering the world of AIFs or a smart investor exploring curated SIF deals, our team offers end-to-end support.

Want to explore pre-IPO investment platforms in India or private investment opportunities below ₹25 lakh?

Call us | Visit www.ritscapital.com | ✉️ info@ritscapital.com

Rits Capital

Your Gateway to India’s Most Powerful Alternative Investments.