How to Safely Invest in Unlisted Shares in India in 2025 ?

Saxena Varun 4 min read 25When it comes to wealth creation in India, the spotlight has always been on listed shares, mutual funds, and real estate. But in recent years, a new star has emerged in the investment world: unlisted shares. If you’re wondering what these are, think of companies like Tata Technologies (before IPO), Reliance Retail, or HDB Financials — companies that aren’t yet traded on public stock exchanges but are still valued and traded privately.

However, investing in unlisted shares isn’t as straightforward as logging into a brokerage account. It requires a deeper understanding of risks, rewards, and most importantly — regulations. This blog is your complete 2025 guide to safely investing in unlisted shares in India.

What Are Unlisted Shares?

Unlisted shares are equity shares of companies that are not listed on any recognised stock exchange like NSE or BSE. These include startups, pre-IPO companies, subsidiaries of listed firms, and private limited companies.

You can buy them through:

- Employees looking to offload their ESOPs,

- Promoters selling privately,

- Platforms like Rits Capital that specialise in the unlisted share market.

Learn more about asset classes like unlisted equity

Why Invest in Unlisted Shares?

Investors are flocking to unlisted shares for a few key reasons:

- High growth potential — early entry into future unicorns.

- Diversification — beyond mutual funds and listed equity.

- Pre-IPO returns — valuation often jumps once the company lists.

But where there’s potential, there’s also risk. That’s why understanding the regulations in 2025 is critical before you jump in.

2025 Regulatory Snapshot

Here’s what you need to know about the latest framework in India:

1. SEBI’s Role

The Securities and Exchange Board of India (SEBI) governs all capital markets activity, including how unlisted shares can be bought and sold.

In 2025, SEBI has:

- Tightened disclosure norms for pre-IPO placements.

- Mandated enhanced KYC for buyers/sellers of unlisted securities.

- Capped promoter sales for certain categories to prevent price manipulation.

More on SEBI’s mandate: Wikipedia – SEBI

2. Minimum Lock-In Period

If you invest in pre-IPO shares, SEBI requires a 6-month lock-in post-IPO. You can’t sell them immediately on listing day — be ready to wait.

3. Taxation Rules

In 2025:

- Long-term capital gains (LTCG) on unlisted shares (held >24 months) is taxed at 20% with indexation.

- Short-term gains are taxed as per your income slab.

Note: Filing accurate records of purchase/sale is vital, especially since unlisted shares aren’t tracked automatically by most brokers.

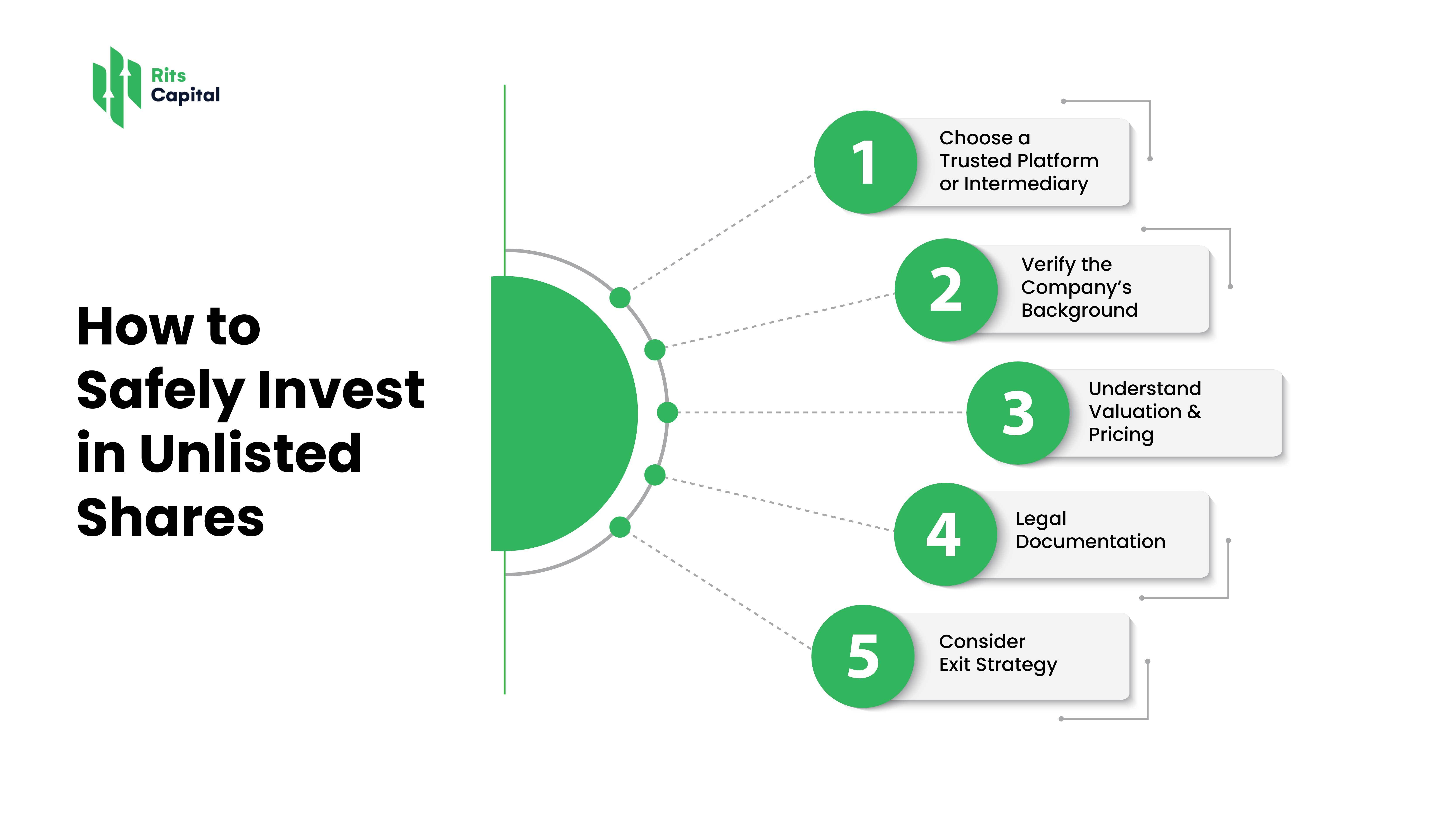

How to Safely Invest in Unlisted Shares

Let’s break this down step by step:

1. Choose a Trusted Platform or Intermediary

Avoid Telegram groups or anonymous sellers. Use credible platforms like Rits Capital that:

- Conduct due diligence on companies,

- Provide audited financials,

- Offer fair pricing and secure contracts.

Explore curated unlisted shares on Rits Capital

2. Verify the Company’s Background

Look for:

- Last 3 years’ financials,

- Debt levels,

- Promoter credibility,

- Pre-IPO track record (if applicable).

3. Understand Valuation & Pricing

Unlisted shares don’t have real-time prices. So:

- Check the latest internal valuation reports.

- Ask for peer comparisons.

- Be cautious if someone offers a “limited time deal” or inflated discount.

4. Legal Documentation

You’ll receive a Share Purchase Agreement (SPA) or Deed of Transfer. Ensure:

- The documents are stamped and signed,

- Your name is updated in the company’s register (ROC).

If you skip this, you may not legally own the shares!

5. Consider Exit Strategy

Ask:

- Will the company go for IPO in 1–2 years?

- Is there an ESOP buyback policy?

- Can you resell the shares to a platform or investor?

Liquidity is lower than in listed stocks, so plan accordingly.

Red Flags to Avoid

- Buying from unknown brokers on social media.

- Investing without understanding the company’s fundamentals.

- Getting lured by “guaranteed IPO profits.”

Unlisted shares are high-reward but high-risk — there are no free lunches.

International Perspective: Are We Catching Up?

Globally, private equity investing has boomed. According to Investopedia, unlisted securities are often used by institutional investors to build long-term wealth.

India is fast catching up, and with SEBI’s stronger 2025 regulations, it’s becoming a more transparent and investor-friendly market for retail participants too.

Quick Checklist Before You Invest

| Item | Check |

| Trusted Source | Yes |

| Company Due Diligence | Yes |

| Legal Paperwork | Yes |

| Exit plan | Yes |

| Tax Implications | Understood |

Final Thoughts

Investing in unlisted shares in India can be incredibly rewarding — but only if done right. With better platforms, increased transparency, and tighter regulations in 2025, retail investors now have a safer path to access this once-exclusive asset class.

Always remember: returns are a result of risk management, not luck.

At Rits Capital, we help you navigate the world of private markets with curated opportunities, due diligence, and regulatory compliance. Whether you’re a first-time investor or an HNI building your private portfolio, our team is here to guide you.

FAQs

Q1. Are unlisted shares legal in India?

Ans: Yes, buying and selling unlisted shares is fully legal when done through authorised channels.

Q2. Is there a lock-in period for unlisted shares?

Ans: Yes, for pre-IPO shares, SEBI mandates a 6-month lock-in after listing.

Q3. How can I check if a company is trustworthy?

Ans: Ask for audited financials, shareholding pattern, and valuation reports before investing.

Q4. Do I need a Demat account for unlisted shares?

Ans: Yes, most unlisted shares are transferred in demat mode through NSDL or CDSL.

Q5. Can I invest in startups through unlisted shares?

Ans: Yes, especially those in growth stage or preparing for IPOs.