Hexaware Technologies Limited IPO: A Comprehensive Guide

Saxena Varun 4 min read 25Are you interested in investing in the Hexaware Technologies Limited IPO? Look no further! In this blog post, we’ll provide you with a comprehensive guide to help you make an informed decision.

What is Hexaware Technologies Limited?

Hexaware Technologies Limited is an Indian IT consulting and services company that provides a range of services, including application development, testing, and maintenance. According to Wikipedia, the company was founded in 1990 and has since become a leading player in the Indian IT industry.

IPO Details

Here are the key details of the Hexaware Technologies Limited IPO:

– Issue Size: ₹8,750 crores (approximately $1.17 BillionsUSD)

– Issue Price: ₹674-708 per share

– Listing Date: Feb-19, 2025

– Listing Exchange: National Stock Exchange (NSE) and Bombay Stock Exchange (BSE)

Financial Performance

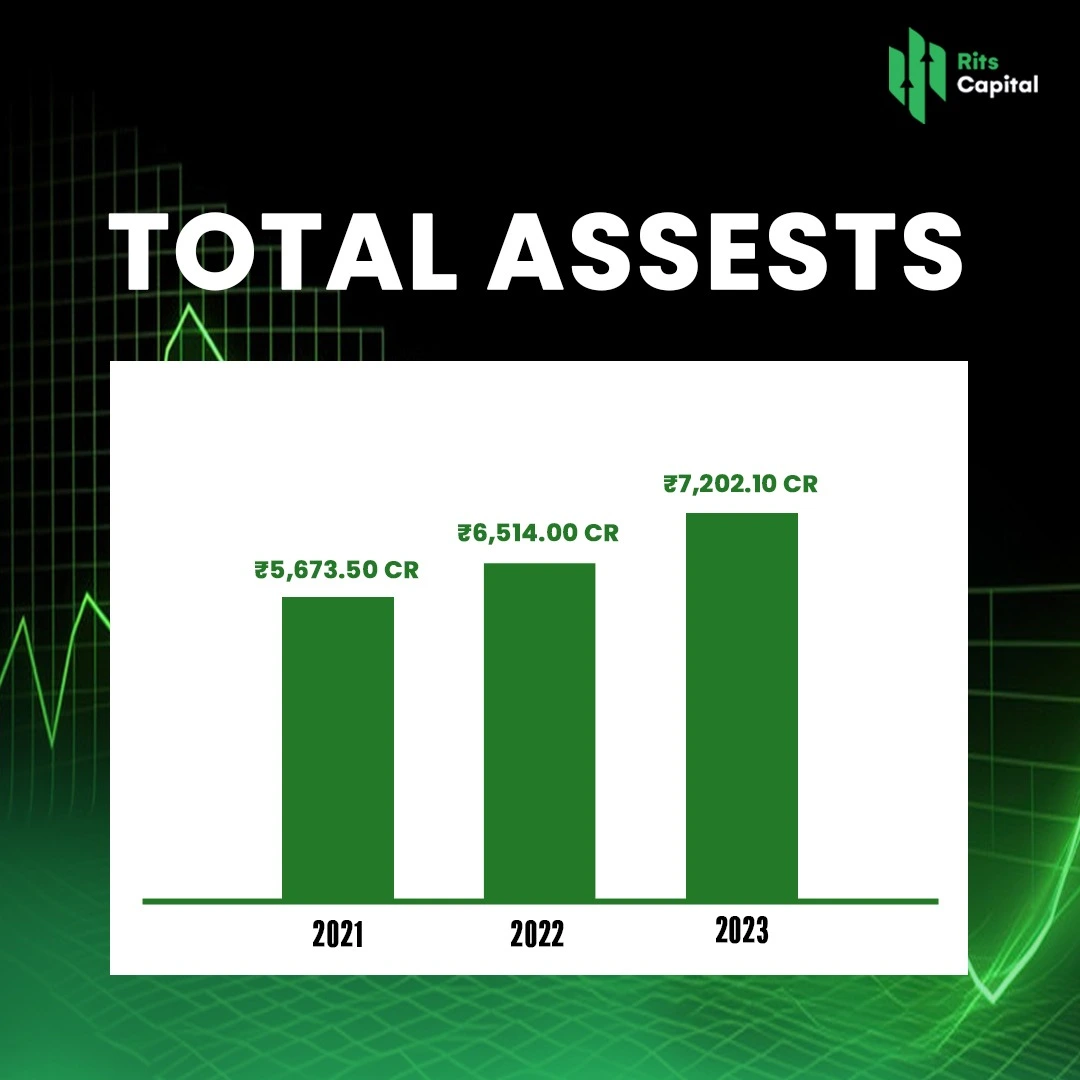

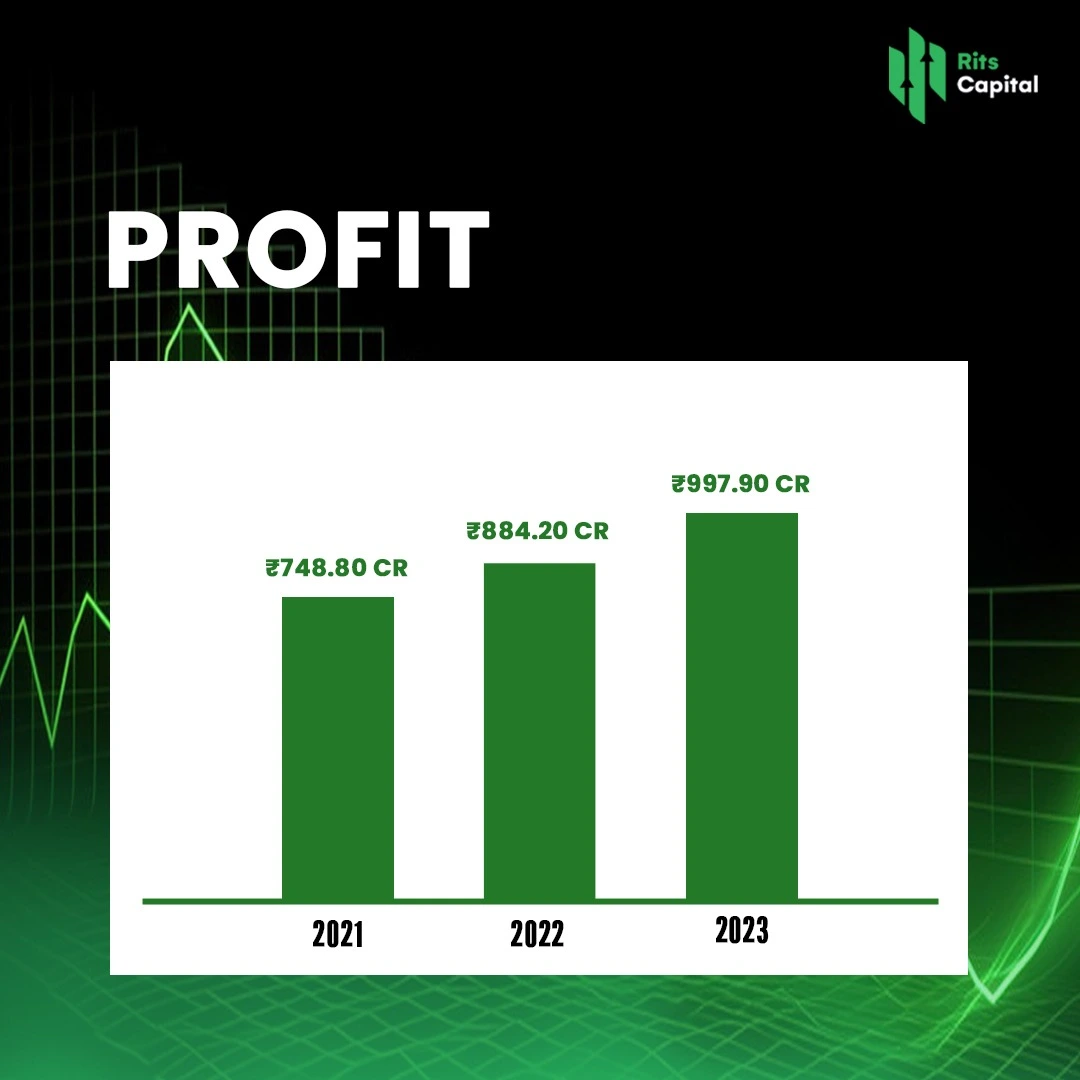

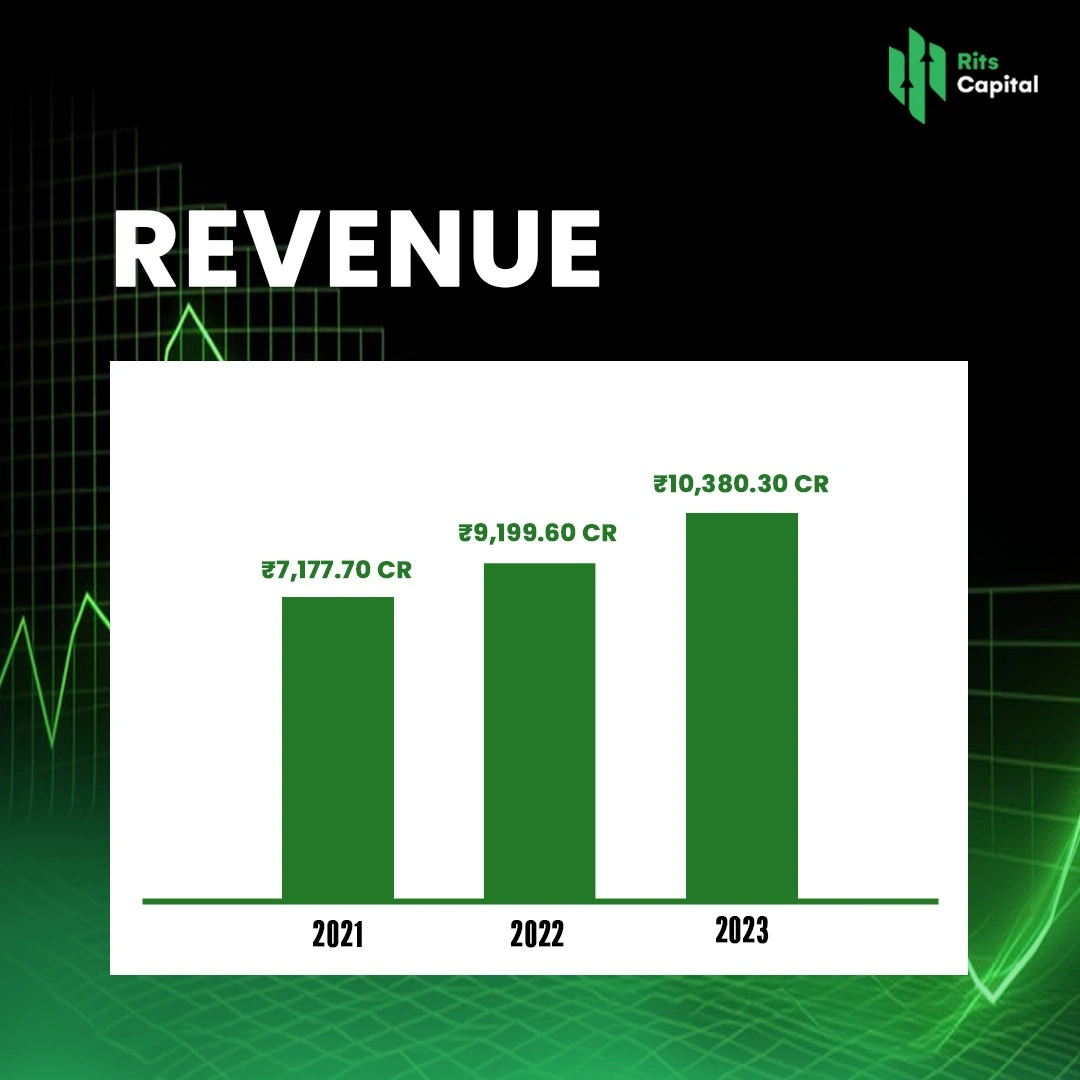

Hexaware Technologies Limited has a strong financial track record, with:

Why Invest in Hexaware Technologies Limited IPO?

Here are some compelling reasons to invest in the Hexaware Technologies Limited IPO:

- Growing Demand: The demand for IT services is growing rapidly, driven by digital transformation and cloud adoption.

- Strong Financials: Hexaware Technologies Limited has a strong financial track record, with consistent revenue growth and profitability.

- Experienced Management: The company has an experienced management team with a proven track record in the IT industry.

Risks and Challenges

While investing in the Hexaware Technologies Limited IPO can be attractive, there are also risks and challenges to consider:

- Market Volatility: The stock market can be volatile, and the price of Hexaware Technologies Limited shares may fluctuate.

- Competition: The IT services industry is highly competitive, and Hexaware Technologies Limited faces competition from established players.

- Regulatory Risks: The company is subject to various regulatory risks, including changes in government policies and regulations.

Expected Listing Price

Based on the issue price of ₹285-300 per share and the strong demand for the IPO, analysts expect the listing price to be around above 5% -10% of the issue price. However please note that our expected listing price is calculated on our expected. You can consult your financial advisor for more exact price.

Conclusion

The Hexaware Technologies Limited IPO offers an attractive investment opportunity for those looking to invest in the IT industry. With a strong financial track record, experienced management team, and growing demand for IT services, this IPO is definitely worth considering. However, it’s essential to carefully evaluate the risks and challenges associated with investing in the IPO.

FAQs

The issue size of the IPO is ₹8,750 crores (approximately $1 Billion USD).

The issue price of the IPO is ₹674-708 per share.

The IPO will be listed on 19, feb, 2025.

The minimum investment required is ₹14,154.

Yes, you can apply for the IPO online through various online platforms.

Yes, you can sell your shares immediately after listing.

The risks associated with investing in the IPO include market volatility, competition, and regulatory risks.

You can check the allotment status of your IPO application on the website of the registrar.