SIP vs FD: Which Investment Option Is Right for You?

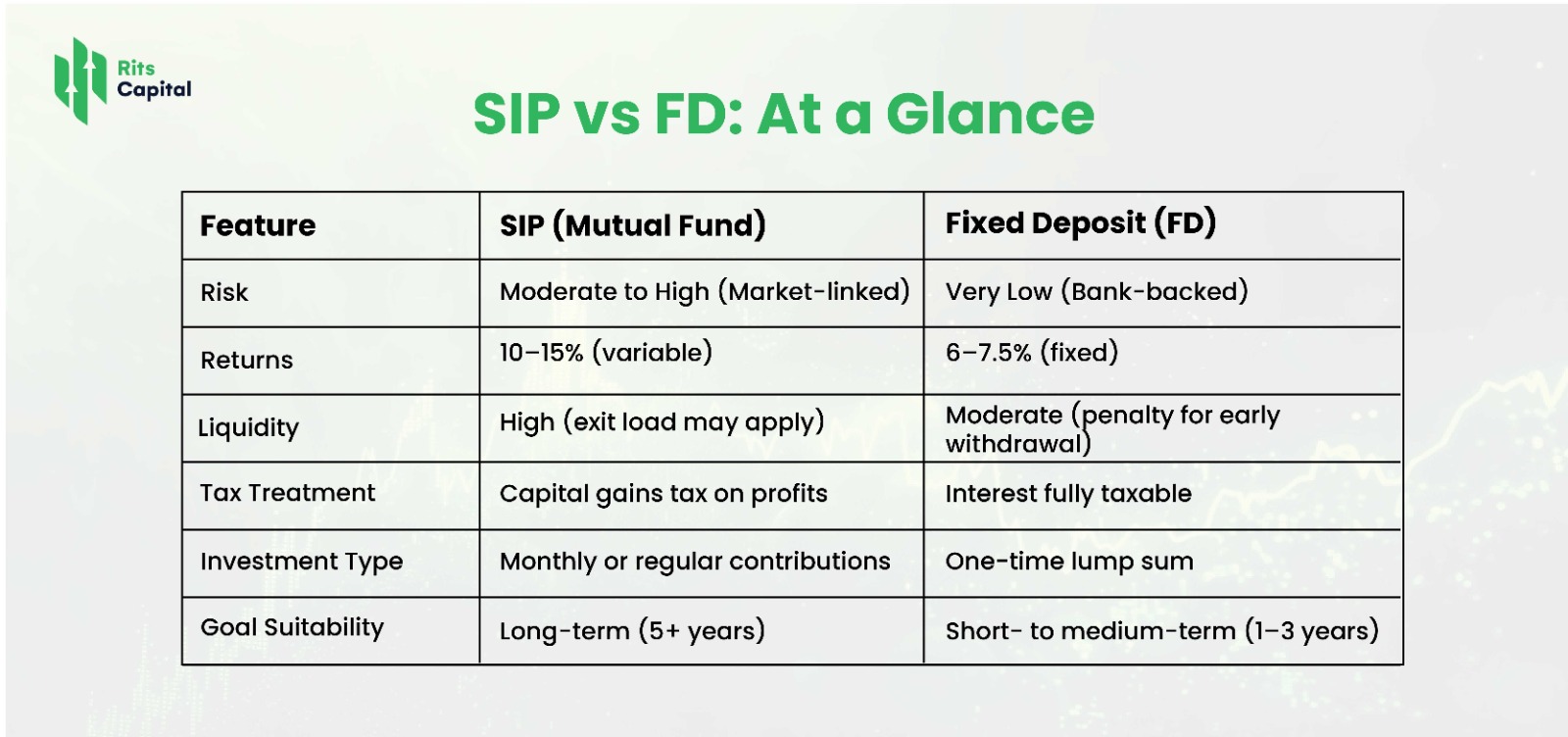

Saxena Varun 4 min read 25When it comes to growing your money in a structured, reliable way, (Systematic Investment Plan) SIP vs FD (Fixed Deposit) are two of the most popular options in India. But while both aim to grow your wealth, they operate in fundamentally different ways.

This article will help you understand the key differences and choose the option that best suits your financial goals.

What is a SIP?

A Systematic Investment Plan (SIP) is a disciplined way of investing in mutual funds. You contribute a fixed amount regularly—typically monthly—into a fund that invests in equities, debt, or a hybrid mix.

- Returns depend on the performance of the mutual fund and market trends.

- Historically, equity SIPs have delivered average annual returns of 10–15% over the long term.

- SIPs are ideal for long-term goals such as retirement, education, or wealth building.

For a deeper explanation, visit Investopedia’s guide on SIPs.

What is a Fixed Deposit (FD)?

A Fixed Deposit is a traditional savings instrument offered by banks and NBFCs. You invest a lump sum for a fixed tenure, and the bank pays you a predetermined interest rate—regardless of market fluctuations.

- Offers guaranteed, low-risk returns.

- FD interest rates in 2025 typically range between 6% and 7.5%.

- Ideal for short-term saving or when capital preservation is the priority.

To understand how FDs work in India, refer to the Wikipedia page on Fixed Deposits.

Which One Should You Choose?

SIP may be right for you if:

- You’re investing for a long-term goal (5+ years).

- You’re comfortable with market-linked risks.

- You want inflation-beating returns.

FD may be right for you if:

- You want guaranteed, fixed returns.

- You have a short-term financial goal or need capital protection.

- You prefer simplicity and low or no market exposure.

At Rits Capital, we often recommend building a hybrid strategy—allocating funds to both SIPs and FDs based on your risk tolerance, time horizon, and liquidity needs.

Final Thoughts

Both SIPs and FDs offer value in different contexts. SIPs can build long-term wealth, while FDs offer short-term stability and guaranteed returns. The best investment option is the one that aligns with your financial goals—not just market trends.

Need help building your personalized investment strategy?

Let Rits Capital guide you in crafting a balanced, goal-oriented portfolio.

Frequently Asked Questions (FAQs)

1. Is SIP safer than FD?

No. SIPs are market-linked and subject to volatility, while FDs offer guaranteed returns. SIPs carry higher risk but potentially higher rewards, especially over the long term.

2. Can I break an FD or SIP mid-way?

Yes. FDs can be prematurely closed, often with a penalty. SIPs can be stopped or withdrawn anytime, but there may be exit loads or tax implications if done too early.

3. Which is better for tax-saving: SIP or FD?

Some SIPs (ELSS funds) offer tax benefits under Section 80C. Tax-saving FDs also qualify under 80C but have a lock-in period of 5 years. ELSS funds generally offer better post-tax returns.

4. Can I invest in both SIP and FD together?

Absolutely. In fact, diversifying between both is a smart strategy. SIPs help with long-term wealth creation, while FDs offer safety and stability for your short-term needs.

5. Are SIP returns guaranteed?

No. SIPs are linked to mutual fund performance and hence depend on market conditions. However, staying invested for a longer duration typically smooths out short-term volatility.