Understanding Category I, II, and III AIFs in India

Saxena Varun 4 min read 25Alternative Investment Funds (AIFs) have become a hot topic among HNIs and sophisticated investors looking for higher returns, portfolio diversification, and access to unique opportunities. But here’s the catch — most people get confused between Category I, II, and III AIFs.

If you’re nodding in agreement, this blog is your simplified, no-jargon guide to understanding the three categories of AIFs in India, what makes them different, and how to decide which one fits your goals.

What Is an AIF?

An Alternative Investment Fund (AIF) is a privately pooled investment vehicle that collects money from investors to invest by a defined strategy. These aren’t your regular mutual funds — they’re designed for qualified investors seeking exposure beyond the public markets.

SEBI (Securities and Exchange Board of India) regulates AIFs under the SEBI (AIF) Regulations, 2012. AIFs are classified into Categories I, II, and III, based on their investment style and risk profile.

Category I AIFs – Backing the Future

What They Are:

Category I AIFs invest in economically and socially desirable sectors. Think startups, infrastructure, SMEs, or green projects.

These funds are encouraged by the government because they align with national priorities — so they may receive incentives or tax benefits.

Typical Investments:

- Venture Capital Funds

- Angel Funds

- Social Venture Funds

- Infrastructure Funds

Key Features:

- Long-term investment horizon

- Higher risk, but potential for higher returns

- SEBI-regulated and often supported by policy initiatives

Ideal For:

HNIs wanting to bet on India’s next big startup or nation-building projects.

Category II AIFs – The Balanced Path

What They Are:

These are the most popular type of AIFs among serious investors. Category II AIFs don’t get special government incentives, but they also don’t take excessive leverage or short positions like Category III.

Typical Investments:

- Private equity

- Debt funds

- Real estate funds

- Mezzanine funds

Key Features:

- Stable return profiles (esp. in private credit and real estate)

- Lock-in periods usually 4–6 years

- No leverage or complex derivatives

- Most regulated Category by SEBI

Minimum Investment:

₹1 crore (except for employees/directors where it’s ₹25 lakh)

Ideal For:

HNIs and family offices looking for moderate risk with predictable returns, especially via private debt or pre-IPO plays.

See Rits Capital’s insights on private market investing

Category III AIFs – The Hedge Fund Territory

What They Are:

Category III AIFs are designed for high-return strategies using complex tools like derivatives, leverage, long-short trading, and intraday positions. This is the hedge fund model of India.

They can invest in listed and unlisted securities, but their core play is agility and alpha generation.

Typical Strategies:

- Long-short equity

- Arbitrage

- Quant funds

- Derivative trading

Key Features:

- High risk, high reward

- Higher churn, shorter lock-ins (1–3 years)

- No restrictions on leverage or shorting

- Taxed like business income (unlike LTCG for Cat I & II)

Ideal For:

Sophisticated investors looking for alpha and active trading exposure, often complementing their long-term portfolios.

📖 Read more on hedge fund-like investing

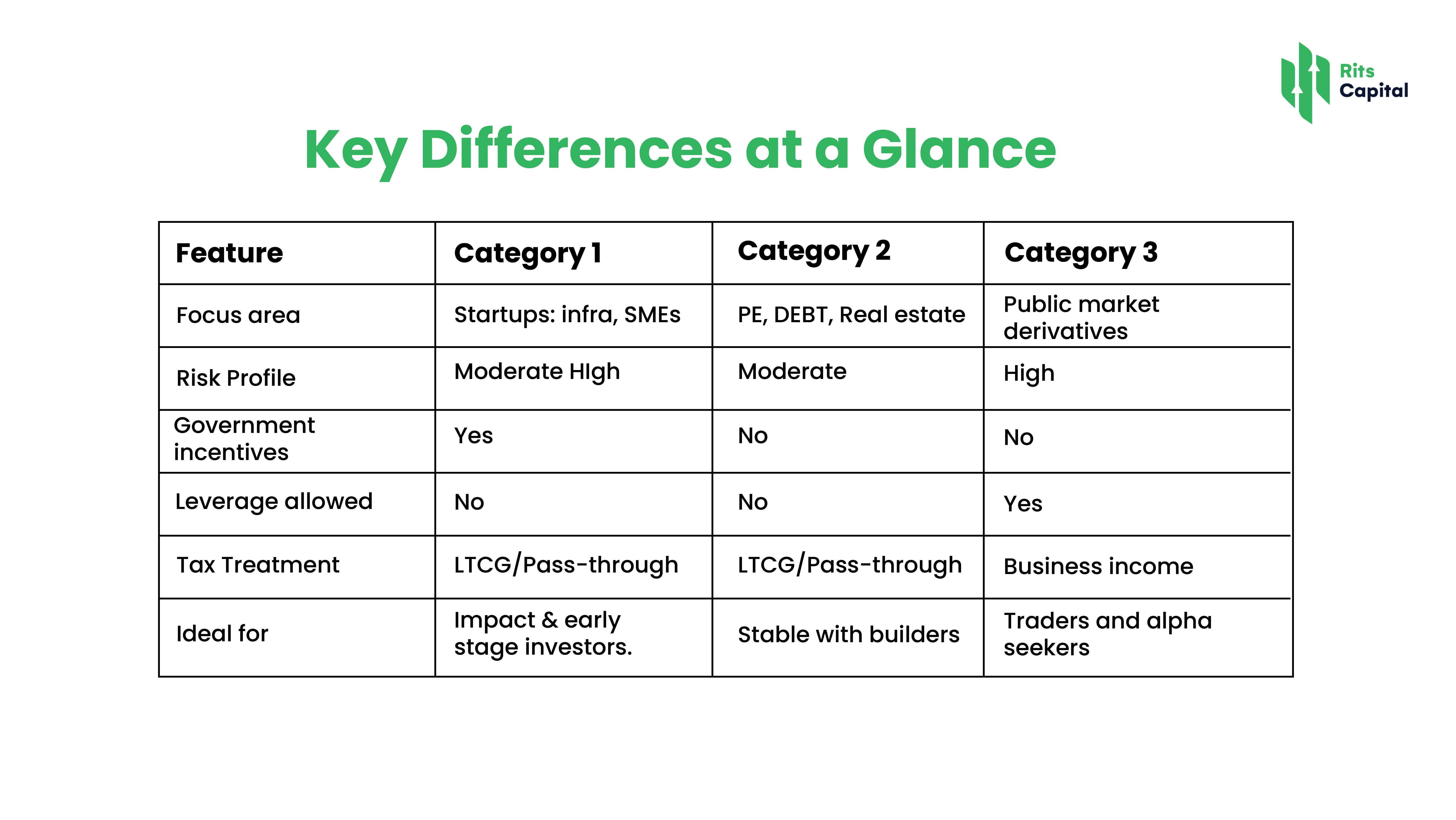

Key Differences at a Glance

Real-World Use Cases

- A tech-savvy investor in Bengaluru might put ₹1 Cr in a Category I AIF that supports early-stage AI startups.

- A conservative HNI in Mumbai could allocate ₹3 Cr into a Category II real estate debt AIF for consistent annual yields.

- A market-savvy entrepreneur might park ₹50 lakh in a Category III quant fund to ride short-term opportunities.

Is AIF Investing Safe?

AIFs are regulated by SEBI, but they are meant for informed investors. Each AIF comes with:

- A Private Placement Memorandum (PPM)

- Detailed strategy, tenure, and risk disclosures

- Professional fund managers with skin in the game

However, unlike mutual funds, AIFs are not daily liquid. You must stay invested until maturity or pre-defined liquidity events.

Final Thoughts

Alternative Investment Funds are no longer niche. In 2025, they’re mainstream for India’s wealth-conscious elite, offering access to private markets, innovation, and active strategies that can’t be found in traditional avenues.

Understanding the three categories — I, II, and III — is key to using AIFs effectively. Whether you’re a growth-seeker, yield-hunter, or market player, there’s an AIF that fits your style.

But don’t invest blind. Work with licensed platforms like Rits Capital that conduct deep due diligence and help you navigate taxation, regulation, and fund performance with clarity.

FAQs:

Q1. Can retail investors invest in AIFs?

No, AIFs are open to accredited investors or those investing ₹1 crore or more.

Q2. What is the lock-in period in AIFs?

Varies by category: 4–7 years for Cat I & II, 1–3 years for Cat III.

Q3. Are returns guaranteed?

No, AIFs are market-linked and come with risk disclosures.

Q4. How are AIFs taxed?

Category I & II: LTCG;

Category III: Business income (higher tax).

Q5. How do I select the right AIF?

Look at the fund manager’s track record, strategy, risk profile, and fund structure.