AIF vs PMS vs Mutual Funds: Where Should You Park Your Wealth in 2025?

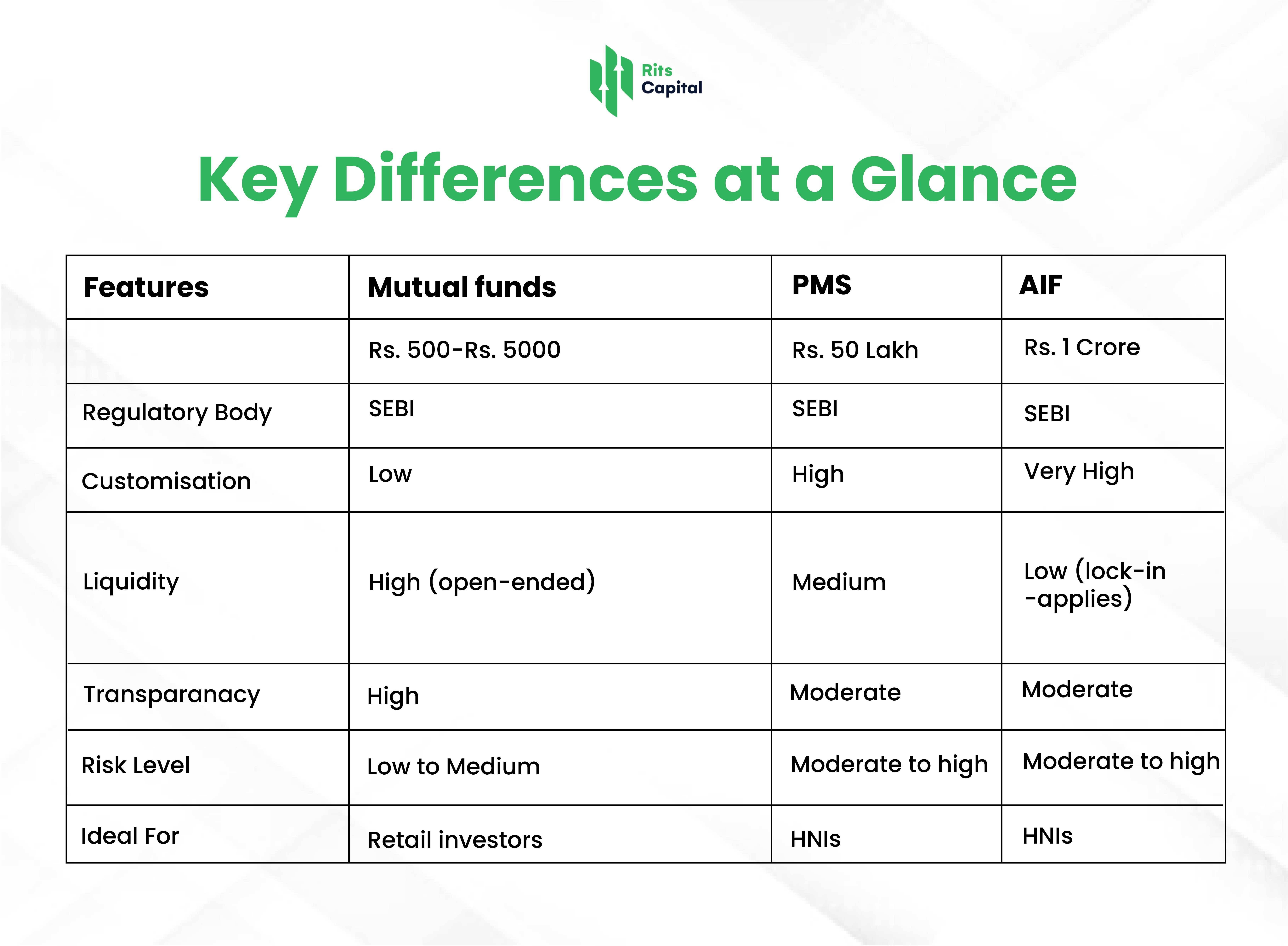

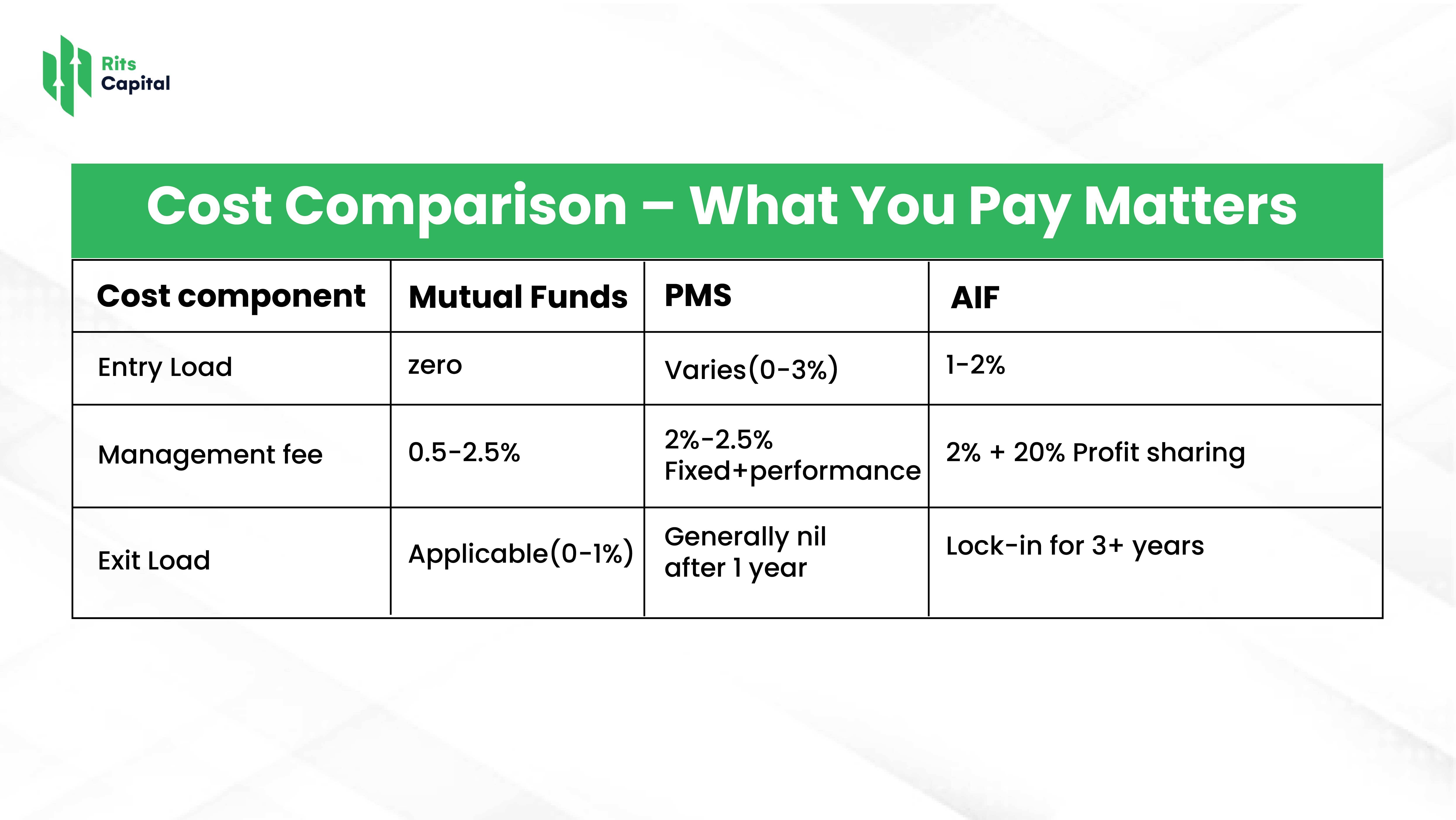

Saxena Varun 4 min read 25In the dynamic world of investing, the choice of a suitable investment vehicle can make or break your long-term wealth strategy. In 2025, Indian investors — especially HNIs (High Net-Worth Individuals) and affluent millennials — are increasingly choosing between three main options: Alternative Investment Funds (AIFs), Portfolio Management Services (PMS), and Mutual Funds.

But which one is right for you? Let’s break it down in simple terms — with real insights, updated numbers, and a 360-degree comparison.

What Are They? – The Basics

Mutual Funds

Mutual funds pool money from various investors and invest in equity, debt, or hybrid instruments. Managed by professional fund managers under SEBI regulations, they are ideal for retail investors.

Portfolio Management Services (PMS)

PMS is a tailored investment strategy where a portfolio manager creates and manages a portfolio specifically for you, typically in equities. It’s meant for investors looking to invest ₹50 lakh or more.

Alternative Investment Funds (AIFs)

AIFs invest in non-traditional asset classes such as private equity, real estate, hedge funds, or venture capital. Minimum investment: ₹1 crore. It’s a sophisticated vehicle, often accessed by HNIs and ultra-HNIs.

For more detailed information about AIF, Click on the following link: What is AIF?

Performance: Who’s Beating the Market in 2025?

1. Mutual Funds (Equity category) delivered an average return of 11-13% CAGR over the past 5 years.

2. PMS strategies, particularly in small-cap and thematic segments, have outperformed mutual funds, clocking 14-18% CAGR for top-performing managers.

3. AIFs, especially Category II (Private Equity and Venture Capital), are showing IRRs of 20% or more, although they come with higher risk and longer lock-in periods.

Pros and Cons

- Mutual Funds

Pros:

- Low cost.

- Regulated and transparent.

- Easy to start and exit.

Cons:

- No customisation.

- Lower returns for aggressive investors.

- PMS

Pros:

- Tailored strategies.

- Greater flexibility.

Cons:

- High ticket size.

- Performance varies across managers.

- AIF

Pros:

- Access to exclusive assets (VCs, PE, Real Estate).

- Higher alpha potential.

Cons:

- High risk.

- Complex structure.

- Long lock-ins.

Who Should Choose What in 2025?

- Salaried or First-time Investors- Stock with mutual funds. SIPs offer disciplined investing. Begin with hybrid or large-cap funds and gradually diversify.

- Professionals & Business Owners with ₹50L+- If you’re looking for capital appreciation with a personal touch, PMS could be your route. Opt for strategies that align with your risk appetite (e.g., focused, smallcap, value investing).

- HNIs, CXOs, and Ultra-Rich Investors-For those with access to ₹1 crore+ and a long-term view (5-7 years), AIFs offer differentiated exposure — from pre-IPO equity to real estate yield funds and credit strategies.

What Does SEBI Say?

SEBI is increasingly tightening norms around PMS and AIFs to improve transparency, reduce mis-selling, and ensure investor protection. In 2025, SEBI is pushing for:

- More frequent portfolio disclosures for AIFs

- Capping performance fees based on hurdle rates in PMS

- Discouraging retail investors from AIFs unless via advisers

This ensures that only informed and eligible investors participate in complex products like PMS and AIFs.

Conclusion: Choose Based on Risk, Returns & Goals

In 2025, Indian investors are spoilt for choice — but clarity is key.

- For liquidity and low risk: Mutual Funds

- For customised strategy and alpha: PMS

- For high-growth, illiquid assets: AIFs

Match the product with your financial goals, investment horizon, and risk capacity. And always, invest with a regulated and experienced partner.

At Rits Capital, we help you build a diversified portfolio across listed and unlisted assets, AIFs, PMS, and beyond — with full transparency and strategic guidance.

FAQs: AIF vs PMS vs Mutual Funds

1. Is AIF better than PMS in terms of returns?

Ans: AIFs may offer higher returns, but they come with higher risk and longer lock-in periods.

2. Can I invest in AIF with ₹10 lakh?

Ans: No. The minimum investment in AIFs is ₹1 crore as per SEBI norms.

3. Are PMS returns guaranteed?

Ans: No. PMS returns are market-linked and depend on the manager’s strategy.

4. Can NRIs invest in AIFs and PMS?

Ans: Yes, many PMS and AIFs accept NRI investments, subject to FEMA guidelines.

5. Which is more liquid — PMS or Mutual Funds?

Ans: Mutual funds are generally more liquid. PMS may require you to stay invested for 1–3 years.

6. What’s the taxation difference?

Ans: Mutual funds follow a well-defined taxation policy. PMS and AIF returns are taxed as per the asset class and holding period.

7. Is diversification possible in AIFs?

Ans: Yes, Category III AIFs often provide multi-asset diversification including derivatives but come with high volatility.

8. Do I need a demat account for PMS?

Ans: Yes. PMS investments are held in your demat account in your name.

9. Are AIFs suitable for retirement planning?

Ans: Not directly. Due to illiquidity and complexity, they’re more suited for wealth creation than income generation.